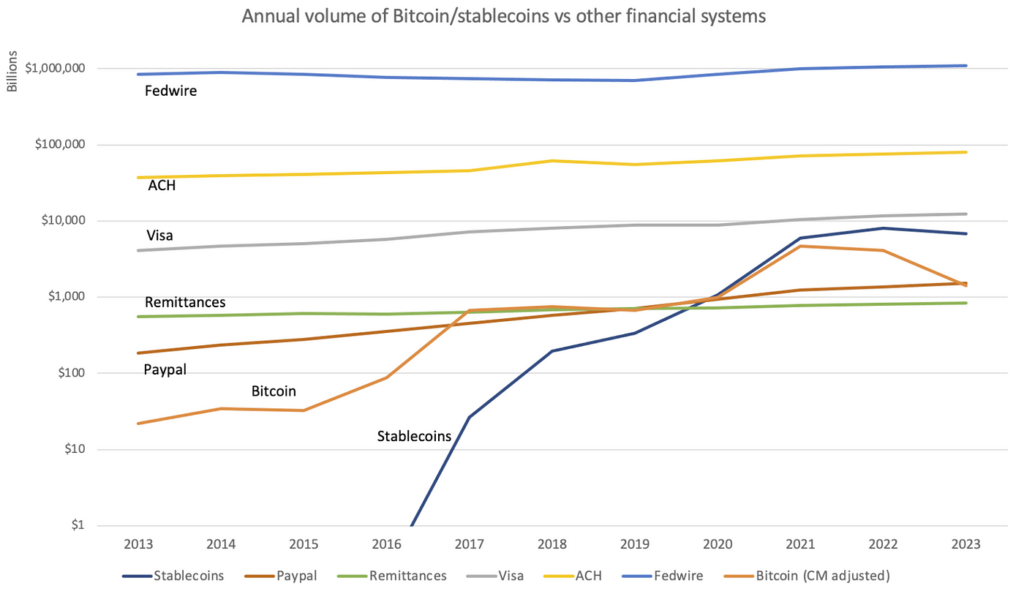

Stablecoins are fast becoming a mass global medium of exchange, and crypto’s killer use case. Currently, stablecoins are responsible for approximately $150–200B of weekly volume settled on-chain, while Bitcoin’s relative measure ranges from $25–50B. Total USD-pegged stablecoin supply currently hovers around $160B, while Bitcoin’s market cap is comfortably $1T+. The velocity of stablecoins exceeds that of Bitcoin by 20x. For years, many crypto users sought to establish Bitcoin as a payment system, but data shows that broad demand is in sending/receiving digital dollars on-chain. In other words, USD, but fast, borderless, and without intermediaries.

Stablecoins have shown remarkable growth compared to traditional systems, and continue to trend towards becoming a universal settlement layer.

(Source: CIV Research)

Robust stablecoin systems have four core requirements: efficiency in speed, cost, reliability, and security. If adequate functionality exists, creating a successful stablecoin payment network becomes a matter of driving adoption. The lion’s share of crypto adoption — users, developers, infrastructure, and applications — currently exists in the Ethereum Virtual Machine (EVM) ecosystem. The EVM has a critical mass of innovation and willing users above the base layer but stands to benefit from base layer performance improvement. We may exist in a future world of Layer 2’s, but this nevertheless thrives off of an optimized base layer. Monad brings a parallelized design to the EVM, resulting in a fast, performant Layer 1 chain that is compatible with innovation native to the EVM ecosystem. Monad, in turn, stands to power stablecoin use cases within the EVM in a way not previously possible.

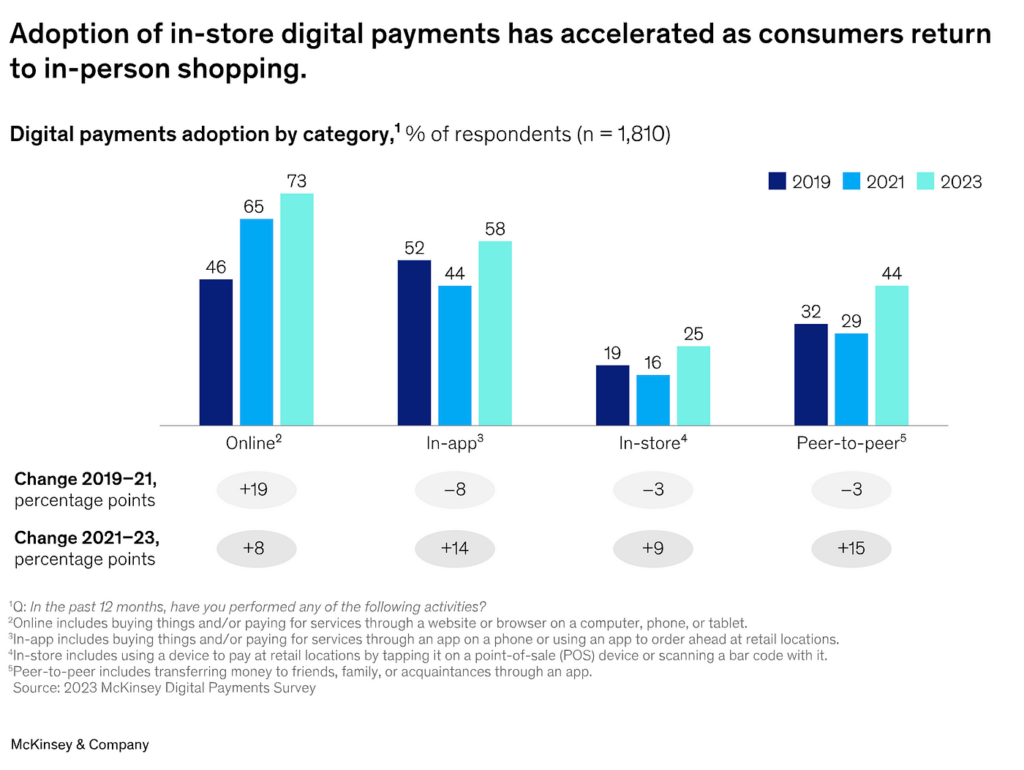

An EVM-based stablecoin payment system is akin to mobile-powered web2 payments. Checks and bank transfers are functional ways of sending money. However, internet users spend most of their time on mobile phones; thus, mobile payments have prospered. In crypto historically, users spend time using EVM-based technology; this presents a market opportunity for a network powering fast, low-cost p2p payments within the EVM sphere. We believe crypto/stablecoin payments will thrive on the back of web2 mobile payment adoption, as prospective users naturally spend more time already using digitally-native commerce solutions.

Online commerce transactions are particularly ripe for stablecoins. Per this 2023 report by McKinsey, digital payment growth (Apple Pay, Google Pay, Samsung Pay, etc.) has been markedly more pronounced for online purchases (73% of 2023 responders) vs in-store (25% of 2023 responders). There appears a greater willingness of consumers to readily adopt novel payment solutions online vs in-person. Possibly, this is due to the friction of using credit cards online (inputting information) vs in-person (simple tap/swipe) which pushes users to newer, incrementally better alternatives.

Through performance and compatibility with existing infrastructure, Monad offers the scalability necessary for stablecoins to continue marching toward global adoption. In recent months, we’ve seen immense growth in stablecoin usage powered by companies like Felix, Yellow Card, OvalFi, DolarApp, and many others. Many of these companies bring stablecoins to emerging markets, increasing financial freedom for those in relatively less robust local economies. Monad stands to be the piping of this emerging global payments layer. CIV will continue to support companies building in the Monad, stablecoin, and Monad x stablecoin arenas.

Disclosure: CIV is an investor in Monad. Felix, Yellow Card, and DolarApp are also CIV portfolio companies.