2023 was a groundbreaking year for crypto.

Fifteen years ago, Bitcoin emerged as a rival store of value, medium of exchange, and unit of account to fiat currency. In 2015, Ethereum unveiled the power of smart contracts – to trustlessly facilitate contractual agreements, powering a host of modern decentralized finance use cases. In years to follow, new layer 1’s and layer 2’s brought about improvements in the speed and cost of execution.

New blockchains coexisted, but were largely segmented. Value creation stayed largely within the confines of its chain of origin. Technologies like LayerZero, Axelar, and Wormhole progressively made it easier for users and applications to traverse blockchains, but until recently there was little to no synergy between chains.

In 2023, we witnessed an emergence of technologies that created inter-blockchain synergies for the first time. Eigenlayer pioneered restaking (or “shared staking”) – the re-use of one staked cryptoasset to secure a new network beyond its native one. This allows networks to launch with staking-based security from the outset by “borrowing” security from another staking network. In Eigenlayer’s case, Ethereum’s security is borrowed for re-use in networks built on top of Eigenlayer. Newer players like Babylon (Bitcoin restaking; CIV portfolio company) and Exocore (omnichain restaking) have entered the fray as shared security stands to become increasingly common practice.

In another trend, new layer 2 blockchains are increasingly utilizing networks outside of Ethereum for data availability. Celestia (CIV portfolio company) and Avail are two leaders in outsourced DA.

Finally, some new participants look to reconcile technology from one virtual machine (a base layer of blockchain technology) with a new ecosystem. Movement Labs and Eclipse, respectively, are building L2’s that bring Move VM and SVM technology to Ethereum. These innovations mark a transition for crypto, with different blockchain ecosystems moving beyond being interoperable to symbiotic.

Despite the breakthroughs of 2023, we see one opportunity ripe for cross-pollination: Bitcoin and the Bitcoin ecosystem.

Bitcoin L2’s like Lightning and Bitcoin sidechains like Stacks and Rootstock have been around for a number of years, but novel Bitcoin use cases at the scale of newer blockchains have yet to meaningfully flourish. These technologies haven’t catalyzed mass adoption either by Bitcoiners or DeFi users to date.

To date, new Bitcoin layers have largely sought to build entirely new ecosystems on top of Bitcoin. These systems have technological promise but struggle with the cold start problem of attracting new applications, developers, and users.

BOB circumvents this issue with a modern approach to scaling Bitcoin: bringing the ecosystem of Ethereum to the mass of Bitcoin users and capital. BOB is building an EVM-compatible Bitcoin L2.

Alexei Zamyatin and Dominik Harz, the co-founders of BOB, have been active in the Bitcoin space for almost 10 years. In 2019, Zamyatin and Harz set out to build Interlay, a DeFi hub for Bitcoin built on Polkadot rails. Interlay delivered novel DeFi functionality to Bitcoin but was hindered by limited Polkadot adoption. Following the experience of building and managing Interlay, the pair set out to harness the adoption of the EVM and build BOB.

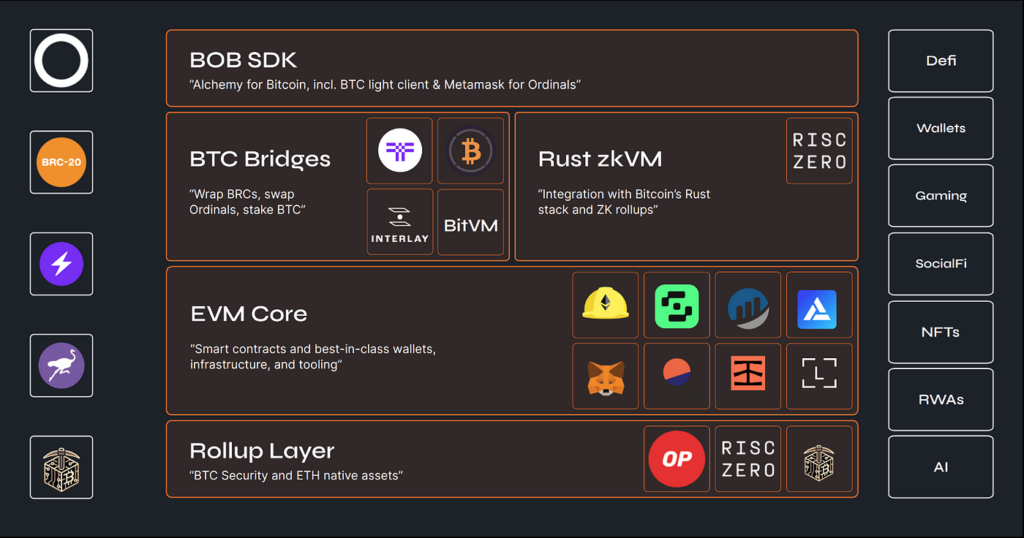

BOB (“Build on Bitcoin”) is a first-of-its-kind hybrid layer 2 powered by Bitcoin and Ethereum. BOB seeks to close the gap between Bitcoin as a vehicle for mass adoption and Ethereum as a hub for innovation by combining the security, liquidity, userbase, and innovation of the two largest blockchain ecosystems. Structurally, BOB leverages the EVM at its base layer to power smart contracts and will launch on the OP stack as its system of rolling up to Ethereum L1. From there, BOB will introduce Bitcoin PoW security via a new, more efficient form of merged mining, making BOB one of the most robust L2s in the market. Eventually, BOB looks to settle directly on Bitcoin L1 through new unlocks like BitVM. Initial Bitcoin liquidity on BOB will come from leading Bitcoin bridges. BOB’s direct access to stablecoin liquidity from Ethereum, as well as BTC and novel types of Bitcoin assets leaves it uniquely positioned to foster a lively environment of applications and users.

BOB’s Core Stack

(Source: https://docs.gobob.xyz/docs/learn/introduction/stack)

BOB sets the stage for symbiotic protocols that sit between Bitcoin and the EVM ecosystem. Ultimately, we see BOB as enabling a proliferation of new Bitcoin use cases in years to come, including:

- Stablecoin-based payments and DeFi

- 1-click deployment of BTC into DeFi strategies

- High-performance DeFi

- Real World Assets On-chain

- Lending/borrowing

- Cross-chain Swaps & Interoperability

- Access to Ordinals, Runes, and other Bitcoin assets for ETH and EVM users

The team at Castle Island Ventures is excited to partner with BOB and continue to invest in the future of Bitcoin innovation.

For more information on BOB, please visit BOB’s documentation: https://docs.gobob.xyz/

With thanks to Alex Lin and Jake Lynch for proofreading and feedback. Photos courtesy of the BOB team.

Disclosure: Of the other companies/protocols mentioned in this piece, CIV is an investor in Babylon and Celestia.